Compliance by Design: Embedding Validation APIs into Your Product Architecture

Compliance by Design: Embedding Validation APIs into Your Product Architecture

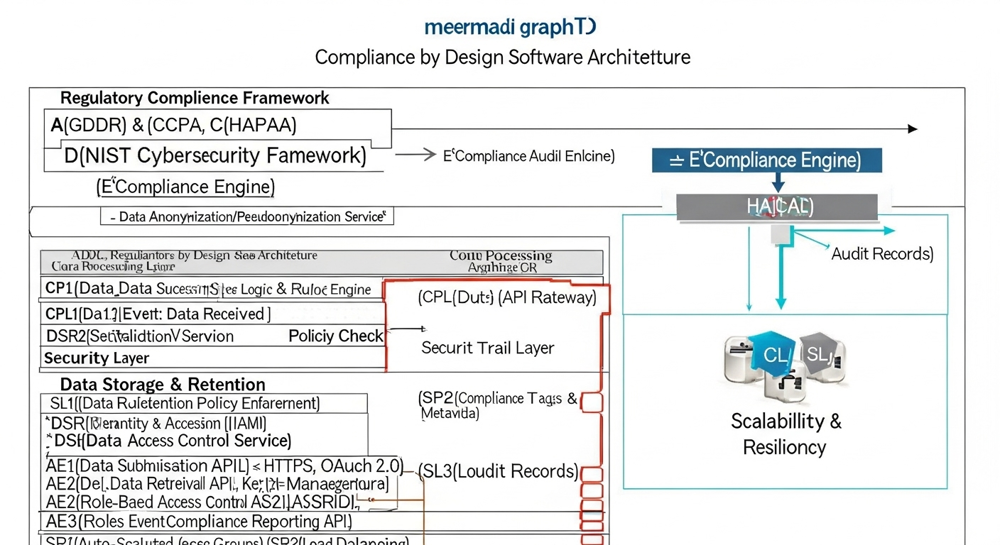

In today's rapidly evolving digital landscape, regulatory compliance isn't just a hurdle to overcome; it's a strategic imperative that, when handled correctly, can differentiate your product and build user trust. For software architects and product teams, the concept of "Compliance by Design" (CbD) offers a powerful paradigm: embedding compliance functionalities directly into the architecture from the outset, rather than bolting them on as an afterthought. This approach, heavily reliant on robust API integrations, ensures scalability, agility, and maintainable adherence to ever-changing regulations.

The Modern Compliance Dilemma for Growing Businesses

Consider "FastPay," a rapidly growing fintech startup. Their onboarding process, initially manual or semi-automated, involves verifying user identities, contact details, and screening against various watchlists. As FastPay scales, manual checks become a bottleneck, leading to:

- Increased Operational Costs: A dedicated compliance team growing linearly with user base.

- Slowed Onboarding: Friction in the user journey, leading to abandonment.

- Heightened Risk: Manual errors, delayed updates to sanctions lists, and non-compliance fines (e.g., AML/KYC violations can incur significant penalties).

- Technical Debt: Retrofitting compliance features into existing, complex systems is expensive, time-consuming, and prone to breaking functionality.

Without CbD, FastPay faces a daunting challenge: how to maintain rapid growth while ensuring regulatory adherence without prohibitive costs or user experience degradation. This is where API-driven compliance becomes indispensable.

The API-First Solution: Building Compliance In, Not Bolting On

An API-first strategy for compliance means leveraging specialized services that offer real-time validation and screening capabilities. These APIs abstract away the complexity of maintaining vast databases, implementing intricate logic for checks, and staying abreast of regulatory changes. By integrating these services directly into your product's core workflows, you automate checks, reduce human error, and ensure a consistent, scalable compliance posture.

Onboarding Buddy's API suite exemplifies this approach, offering a comprehensive set of tools for embedding compliance from the ground up.

Key Onboarding Buddy APIs for Proactive Compliance

1. Email and Mobile Validation: Enhancing Data Quality and Reducing Fraud

Accurate contact information is foundational for secure user communication and fraud prevention. Onboarding Buddy's validation APIs allow you to verify email addresses and mobile numbers in real-time during user registration or profile updates. This helps in:

- Minimizing bounce rates for emails.

- Ensuring deliverability for critical SMS notifications.

- Identifying potentially fraudulent or disposable contact details.

Here's a Python example for validating an email address:

import requests

import uuid

headers = {

"ob-app-key": "<your-app-key>",

"ob-api-key": "<your-api-key>",

"ob-api-secret": "<your-api-secret>",

"Content-Type": "application/json"

}

payload = {

"correlationId": str(uuid.uuid4()),

"emailAddress": "test@example.com"

}

response = requests.post(

"https://api.onboardingbuddy.co/validation-service/validation/email",

headers=headers,

json=payload

)

response.raise_for_status()

print(response.json())

2. Sanctions Screening: The Cornerstone of KYC/AML

KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations require businesses to screen individuals and entities against global sanctions lists. Onboarding Buddy provides APIs for:

- Individual Sanctions Checks: Screening potential users or clients.

- Entity Sanctions Checks: Verifying businesses or organizations.

- Crypto Wallet Sanctions Checks: Crucial for virtual asset service providers (VASPs) to prevent illicit transactions.

- Vessel and Aircraft Sanctions Checks: Specialized checks for industries dealing with shipping and aviation.

By automating these checks, FastPay can ensure they are not inadvertently facilitating transactions with sanctioned parties. Here’s a Python example for performing an individual sanctions check:

import requests

headers = {

"ob-app-key": "<your-app-key>",

"ob-api-key": "<your-api-key>",

"ob-api-secret": "<your-api-secret>",

"Content-Type": "application/json"

}

payload = {

"firstName": "John",

"lastName": "Doe",

"birthYear": "1980"

}

response = requests.post(

"https://api.onboardingbuddy.co/sanction-service/check/individual",

headers=headers,

json=payload

)

response.raise_for_status()

print(response.json())

3. IP Address and Browser Validation: Layered Security and Risk Assessment

Beyond personal identifiers, understanding user behavior and origin adds critical layers to risk assessment. IP address and browser validation APIs can:

- Identify suspicious geographic locations or known VPN/Tor usage.

- Detect unusual browser patterns or outdated software, potentially indicating a bot or compromised device.

Benefits of API-Driven Compliance Architecture

Adopting a Compliance by Design approach with validation and sanctions APIs brings several significant advantages:

- Scalability: APIs handle variable load, allowing your compliance infrastructure to scale seamlessly with your user base.

- Agility: Rapid adaptation to new regulations or list updates is managed by the API provider, not your internal team.

- Reduced Operational Overhead: Automation significantly cuts down on manual review time and resources.

- Real-time Checks: Instantaneous validation minimizes fraud windows and improves user experience.

- Enhanced Auditability: API logs provide clear audit trails for regulatory scrutiny.

- Focus on Core Business: Your team can concentrate on innovation rather than building and maintaining complex compliance engines.

Future Trends in Compliance Technology

The future of compliance is dynamic and will continue to be shaped by technological advancements:

- AI and Machine Learning: AI will play an increasing role in predictive risk analysis, identifying complex fraud patterns, and enhancing the accuracy of sanctions screening by reducing false positives.

- Continuous Monitoring: Shifting from point-in-time checks to continuous, real-time monitoring of user behavior and transaction patterns.

- Decentralized Identity: The rise of blockchain-based decentralized identity solutions could streamline certain aspects of KYC, offering greater user control and privacy while maintaining verifiability.

- Proactive Regulation: Regulators are becoming more tech-savvy, pushing for technology-driven solutions and potentially mandating certain API integrations for compliance.

By adopting a Compliance by Design strategy with API integrations, your product architecture will be future-proofed, resilient, and ready to meet these emerging challenges head-on.

Build for Compliance

Don't let compliance be an afterthought. Architect your product for success from day one. Request a consultation with our API architects to see how Onboarding Buddy can help you embed robust validation and sanctions checks into your systems efficiently.

Onboarding Buddy BETA

Onboarding Buddy BETA